1990

A Portuguese Air Traffic Controllers strike saw 187 passengers stuck at Manchester and 140 in Gatwick. Their flights eventually departed 21 hours late. Other Dan-Air flights to the Canary Islands managed to circumnavigate flights into Moroccan airspace before landing. The Moroccan airspace soon became congested and couldn't cope with demand. A second day of strike action resulted in delays of up to 18 hours for 20 Dan-Air flights.

Thousands of holiday-makers faced a £10 per person surcharge on their summer holidays this year, imposed by Tour Operators who blamed the price hike on the soaring cost of aviation fuel. Currency fluctuation and the general increase in flying costs saw more than 40 Tour Operators apply to the Association of British Travel Agents (ABTA) for approval for the increase. The price of fuel had gone up by 30% during January alone. Dan-Air and Air Europe applied to the Civil Aviation Authority to increase air-fares. cut-throat competition saw several firms hold back from price increases in the hope of attracting new business, but the majority of holidays (80%) were taken using the main Tour Operators: Thomson, Intasun, Horizon, Cosmos and Airtours. ABTA said that because charter airlines were fighting for business many of them were expected to try to absorb the losses, a Dan-Air spokesman said: 'A sharp rise in fares looks inevitable, it seems certain that customers will be affected, but it is impossible to say by how much. Several ski customers have had to pay a surcharge after the pound fell against the Swiss Franc.'

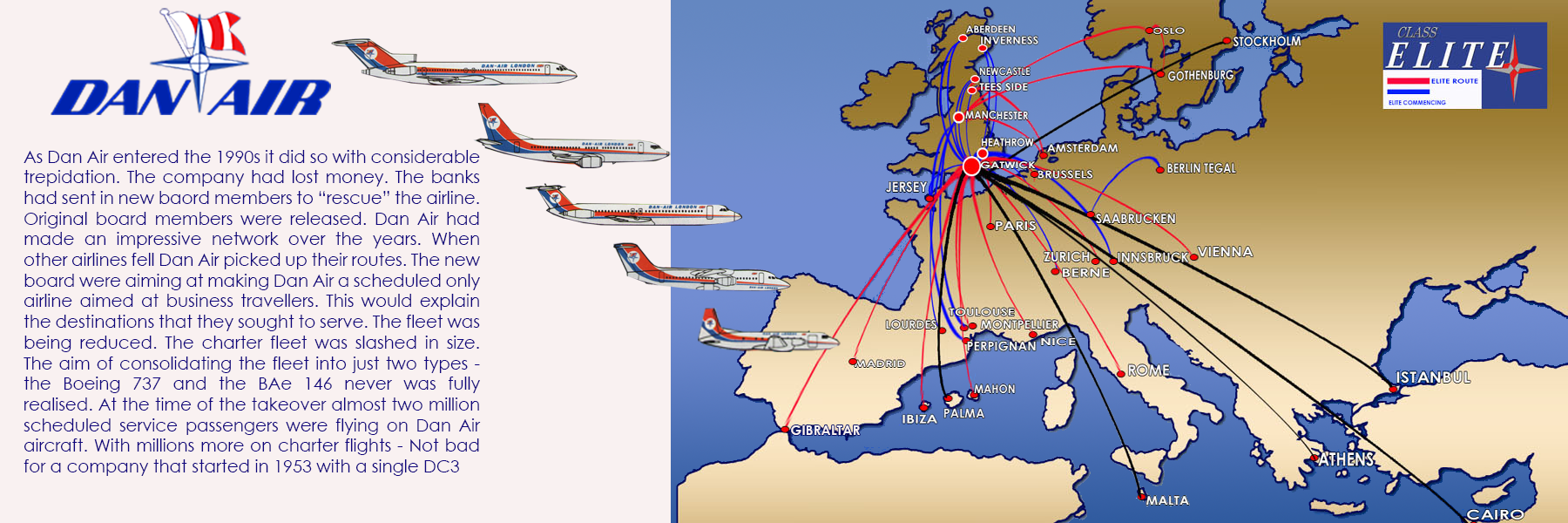

Dan-Air announced that a record 6,275,000 were carried in 1989. There had been increases in charter passengers and scheduled service passengers. Peter Clegg said 'Many of our scheduled services have seen the introduction of jet aircraft which have almost double the capacity of the turboprop airliners that were used previously. We have also upgraded other popular scheduled services with larger jets. On top of that we had a very successful summer period. We have some exciting new plans that will hopefully mean lots more people choose to fly with Dan-Air this year.'

Joan Garnett who, at 59 years old, was believed to be Britain's oldest air stewardess retired this year after flying with Dan-Air for thirty years. Her last flight was a return trip to Paris.

Dan-Air had successfully applied to provide scheduled services between Gatwick and Berlin with flights commencing in March this year. The daily flight would soon become a three times daily return service using Boeing 737 aircraft.

Rumours persisted that Dan-Air's parent company Davies and Newman planned to sell the airline to Air Europe, despite this uncertainty shares rose to 225 on February 21st. sources close to both companies said that Harry Goodman was about to make an offer for the airline. The previous year had seen Dan-Air's 4,000 seat charter capacity cut by 4% following a drop in 1989's package holiday bookings. Analysts had valued Dan-Air at £50,000,000 and they claimed that the majority of revenue came from charter flights. But scheduled traffic had increased and now more that 45 cities were served in eleven countries. The airline had more slot times than any carrier at Gatwick as well. It was speculated that Goodman was turning away from charter flights and wanted to concentrate more on inter-European scheduled flights, which he believed would be the growth market for the 1990s. A source said: 'Last year's bookings were a disaster and shows no signs of improving. D & N must be losing money hand over fist' Interim results showed a loss of £7.6 million in November, but the sale of two Airbus A300 gave D & N a profit over book value, adding a bright spot to what was expected to be a depressing full year result in April this year. The same analysts valued Air Europe at £220 million. ILG had been taken private in 1987 following am management buy-out of £150 million. (The analysis about Air Europe was wildly incorrect)

Two golfers were found guilty of endangering an aircraft after they placed fireworks inside luggage which went into the hold of a company Boeing 727. Some of the fireworks went off as baggage handlers removed the luggage at Gatwick. Eight more sets of fireworks were later found. The men appeared at Chichester Crown Court and were fined £200 each.

It was announced that Dan-Air was withdrawing from the Dublin - London route, citing over capacity from several carriers as the reason. Dan-Air were also under pressure to increase services on other, less populated routes where they could maximise revenue. Five staff at the Dublin office would be offered jobs elsewhere withing the company of made redundant and the office would also close in March.

The expansion of those other services was nowhere more evident than in Scotland. A second company BAC 1-11 was named 'Scottish Connection' in February at a special ceremony. The other BAC 1-11 based at Inverness was called 'Highlander'.

On February 2nd all flights of British Island Airways (BIA) were grounded after the airline went into receivership. A Gatwick spokesman refused to say if their aircraft had been impounded. The airline carried out several charter flights and had operated just three scheduled services, to Malta and Sicily. However, 4000 charter passengers had been booked to fly with BIA in the forthcoming months. The airline had a fleet of five BAC 1-11 and three MD 82 aircraft. The airline had made a loss in 1989 of £4 million against a turnover of £23 million, and increase of 25%. The airline told passengers to check-in as usual, and that they were doing their best to protect passengers.

In a dramatic statement, BIA said that they had instructed their bank, Lloyds to appoint Touche Ross as the official receiver. Lloyds were also the bankers for Dan-Air and Air Europe. The airline's 400 employees were effectively unemployed and passengers overseas would be flown home by another airline. This brought to an end three months of trying to save BIA from a heavy slump in the holiday charter market and high interest rates. In December of 1989 it was believed that BIA had been saved after the promise of a £30 million cash injection from banks, but the fate of the rescue money was now unclear. Touche Ross had arrived at BIA that afternoon and were said to be 'assessing the situation' No further information was given and their shares were suspended. BIA's chairman Peter Villa said he had hopes of a 'strong partner' but that alliance had never materialised.

BIA had debts of £10 Million. Two of the airline's BAC 1-11 jets had been sold off, in an attempt to raise capital. BIA had been profitable until 1988, and was even the chosen carrier for two of Mrs. Thatcher's Election tours. British Island Airways had been a stand alone carrier until they joined with other airlines to form Air UK. A few years later BIA broke away and had formed a second tier airline, based at Gatwick. The 89-seat One-Eleven 400s and 119-seat One-Eleven 500s operated by BIA mark two had filled a niche in the UK charter market, which at the time was dominated by 130-seat Boeing 737-200s, operated by BIA's much bigger, vertically integrated competitors. These smaller, second-hand BAC 1-11s had much lower acquisition costs (compared with the competition's bigger and newer 737-200s) but they enabled BIA to offer tour operators lower capacity aircraft at keener rates, giving them a competitive advantage on less dense routes. The One-Eleven 400's ability to match the 737-200's range, as well as both One-Eleven variants' ability to match the 737's fuel consumption and to comply with stricter, post-1985 noise abatement rules (as a result of having hush kits fitted to their engines), further enhanced BIA's competitiveness vis-à-vis its rivals. This helped attract business from the big tour operators that owned its rivals, especially to secondary European ski destinations served in winter where the lower trip costs of BIA's older planes outweighed the seat-mile cost advantage of the in-house airlines' technologically more advanced equipment. This in turn helped minimise the tour operators' risk, thereby representing a 'win-win' situation for both parties.

The One-Eleven, in a nut-shell was cheap to purchase and worked well on lower density routes. This could not be the long term aim of Dan-Air, who had eighteen of them in service. Newer, much more efficient regional aircraft such as the BAe 146 were available. As ever, the problem for Dan-Air would be how to get hold of them without financially draining the airline. To put this in context: Below is a list of how much fuel (in kilograms) is consumed per hour and the seating capacity on each type.

BAC 1-11 500 - Fuel Consumption 2,800 kg/h (119 passengers)

Boeing 737 200 - Fuel Consumption 2,800 kg/h (130 passengers)

Boeing 737 300 - Fuel Consumption 2,400 kg/h (149 passengers) (Dan-Air 30 Class Elite -40 Economy - Charter config 161)

Boeing 737 400 - Fuel Consumption 2,600 kg/h (156 Passengers) (Dan-Air 30 Class Elite - 66 Economy - Charter config 169)

BAe 146 100 - Fuel Consumption 1,700 kg/h (88 Passengers) (Dan-Air 12-40 Class Elite - 20-62 Economy)

BAe146 300 - Fuel Consumption 1,920 kg/h (96 Passengers) (Dan-Air 16-40 Class Elite - 46-82 Economy)

Boeing 727 100 - Fuel Consumption 4,140 kg/h (141 Passengers)

Boeing 727 200 - Fuel Consumption 4,500 kg/h (189 Passengers)

Boeing 757 200 - Fuel Consumption 3,320 kg/h (231 Passengers)

Boeing 767 200 - Fuel Consumption 4,500 kg/h (276 Passengers)

Airbus A300 - Fuel Consumption 5,000 kg/h (350 Passengers)

Tristar - Fuel Consumption 5,000 kg/h (350 Passengers)

TU 134 - Fuel Consumption 2,500 kg/h (85 Passengers)

TU154B - Fuel Consumption 6,200 kg/h (135 Passengers)

TU154M - Fuel Consumption 5,100 kg/h (152 Passengers)

As you can see, the BAC 1-11 compares quite badly. Dan-Air were also being hit hard by using the Boeing 727 on European charter flights, particularly the 100 series. There seemed little logic in using a Boeing 727 200 carrying 189 people, when a Boeing 767 could carry 276 people for the same amount of fuel. The Airbus A300 that Dan-Air used only slightly more fuel, but carried 74 more passengers than the Boeing 767. Yet still, Dan-Air chose to reduce the Airbus fleet, in an effort to raise cash. Dan-Air's 727 in both 100 and 200 series, used much more fuel than rival carrier's aircraft. Britannia, Air Europe and all the other charter carriers leased their aircraft; resulting in substantial monthly lease payments to the lessor or manufacturer. Whether the balance sheet tipped in favour of the fully owned aircraft was up for debate. One thing is for sure, if a would be Tour Operator came to Dan-Air requiring an aircraft, to match the competitor's price, Dan-Air would be operating on a vastly reduced profit margin. If there was a profit at all.

The British Airports Authority introduced major changes this year which saw wide ranging price increases, some as high as 45%. This led to Dan-Air announcing fare increases of up to 7% on scheduled services. A spokesman said: 'It's a sad fact of life that we have had to make these increases, but we reckon seven per cent isn't that bad when you consider some of the charges we have to pay. Fuel charges at over 35% and the interest rate increases haven't helped either. '

In 1990, the worldwide recession started to bite in the UK. One of the first things that people forgo, when times are hard, is their overseas holiday. UK bookings were down 40% on the previous year, at the time of the BIA collapse. Press reports said that 'Even industry giant ILG who own Air Europe were feeling the pinch.'

Following the collapse of BIA, Air Europe had jumped on the available Malta services and were soon operating Boeing 757 aircraft out of Manchester and Gatwick to the sunshine island. In April, Dan-Air announced that for only the second time in its history that it had made a loss. 1989's pre tax profits of £9.9 million dropped to a loss of £3.3 million. Share prices tumbled 50p to 355p (An all time high was last year's 570p) Fred Newman stated that high interest rates were partly to blame, as well as an exceptionally hot UK Summer. Newman also claimed the merger of BCal and BA had hurt the airline. Over-capacity on some services had not helped either, as this meant they were unable to increase fares. Their charter division was down 7%. Despite this, overall, Dan-Air had maintained their share of the charter market of between 15 and 20%. Turnover was up 11% at £376m. The sale of two Airbus aircraft had raised £5.1m and the company sold more than £1 million in surplus spare parts. Despite carrying 4.5 million passengers on the charter division, which was only 1% lower than last year. The airline was not able to increase revenue from those charter flights . the reason for this was because they were operating on the same margins as the previous year. This operation was carried out amidst much higher fuel costs. The cost of launching Class Elite had been costly, but almost two million passengers flew on Dan-Air's scheduled network, an increase of 40%.

Further Stories about a merger between Air Europe and Dan-Air resurfaced in March. Goodman was sourced as saying; acquiring Dan-Air would set him on the right path alongside his Air Europe. The source said that there appeared to be no sign that 1989's down-turn had been reversed and that Dan-Air was losing money. A few days later on March 6th, Dan-Air described the rumours as 'Codswallop' George Yeoman of Dan-Air said 'There is no truth in these rumours whatsoever. All airlines have been hit by the recent down-turn on holiday bookings. There is no reason why we should be taken over.'

The new Gatwick-Berlin daily service was launched in March, the same month that Pop Princess Kylie Minogue flew on Dan-Air. The airline offered to whisk the star through a quieter part of the airport, but Miss Minogue insisted on meeting fans saying 'They have been waiting all day to see me.'

Air Europe signed a contract 'of substantial value' with Dan-Air on April 30th. The contract was to carry out the maintenance of Air Europe's Boeing 757 fleet. The contract was to last three and a half years. This followed the contract signed the previous year for Dan-Air to maintain Air Europe's Boeing 737 400 series fleet. The bulk of the work on the twelve string fleet would be carried out at Dan-Air Engineering's new hanger at Gatwick. It would also apply for Air Europe's associate airlines. The engineering base at Lasham would also be involved. Mike Ellis associate Director of Dan-Air Engineering said; 'This is the first major contract where the majority of the work will be predominantly performed out of the new Dan-Air hanger complex at Gatwick Airport.' The engineering division was already involved in the maintenance of more than 100 aircraft of other carrier's fleet as well as the 51 aircraft in their own fleet.

May 1st would see the opening of the new daily (except Saturday) Gatwick -Vienna service. The route was destined to be a great success as it was the only flight between the Austrian capital and Gatwick. Class Elite would feature on all flights. A new innovation 'Space Generator' seats had now been installed on all aircraft with a 'Class Elite' cabin. Vienna was rapidly growing in importance as a commercial centre especially given its close location to eastern Europe. Flights would depart daily at 0800am and arrive in Vienna at 11:10 am. the return was 1202 arriving in Gatwick at 1315.

Secret talks that had taken place in May were leaked to the press. The talks had been between Dan-Air and several interested parties, resulted in a dramatic increase in the Davies and Newman share price, rising from 150p to settle at 575p. This increased the value of the stock market company from £10m to £40.3m. Exactly who was involved in the takeover talks was initially unclear. It was rumoured that both British Midland Airways and British Airways were not involved as they knew any such merger would be referred to the monopolies and mergers commission. Aviation insiders believed that a European or American airline would be most likely to buy Dan-Air, as it was the easiest way to get into the already congested airports of Gatwick and Heathrow. These carriers would also be aware that Dan-Air had massive hanger space at both Gatwick and Manchester. Dan Air went to great lengths to reassure passengers that any passengers booking with Dan-Air would in no way be at risk with contractual obligations. Dan-Air announced that they would be withdrawing from the Inverness-Manchester-Gatwick service, that had been in operation for only fourteen months. Instead, they would be concentrating on the Gatwick-Manchester route which had far better yields. The successful Inverness-Heathrow and the Aberdeen-Gatwick services would increase frequencies. Dan-Air revealed that only 7% of passengers at Inverness had opted for the Gatwick service over Heathrow. The Inverness-Heathrow route had been so successful, that not only had frequencies increased they were now increasing capacity on all flights. The flights would all now be carried out using the larger, 104 seat BAC 1-11 500, adding a further 20 seats to each flight.

A HS 748 prop-liner was involved in a near miss over Germany on 2nd May. The Captain was forced to take a violent nose-dive to avoid a collision with an American military jet. Captain Bob Dearling landed the aircraft safely with passengers lining up to shake his hand. Captain Dearling took violent evasive action to avoid the crash after the jet came within 50 feet of the 748. One of the 16 passengers on board, a German business man was concussed as he was thrown forward. The incident occurred over Saarbrucken which was the destination of the airliner which had departed Berlin. An investigation was launched by the West German authorities. A Dan-Air spokesman said Captain Dearling was under radar control of the US Air Force at the Ramstein Air Base. Two F-15 jets were in the same airspace as the Dan-Air aircraft.

A raft of new route licences were sought in May, with applications for Manchester, Tees-Side and Newcastle to Berlin. Tegal Airport in West Berlin had long been established as a charter base for Dan-Air who supplied flights for the majority of West German Tour Operators and the The GTF (German Tourist Facility.) Dan-Air executives thought it was a good idea to expand scheduled services out of West Berlin beyond the Saarbrucken, Amsterdam and London services. Applications were therefore submitted for licences from Berlin to Moscow, Budapest, Prague, Warsaw and Bucharest. The former Communist states had opened up to the west and Dan-Air was ideally placed to become a major player in the region. With George Yeomans of Dan-Air saying: 'It is our intention to capitalise on our Berlin Tegal base.' - Ultimately the applications were rejected.

Britannia Airways announced that there would be redundancies this year after a difficult twelve months trading for the entire industry. Dan-Air, keen to shake off rumours that they were about to go bankrupt, issued a statement saying; 'Consideration is being given to the possibility of greater co-operation between Dan-Air and other airlines. As part of this process the company is in discussion with a number of interested parties and those discussions may or may not lead to an offer being made for the company. It is emphasised that such an offer is only one of several possible outcomes from such discussions.'

There had been leaks to the press suggesting that the airline was about to be taken over, which Dan-air had initially denied. The airline had intentionally not disclosed which companies they were in talks with. Just days after the statement was released, another leak revealed that British Midland had been in talks with Davies And Newman. British Midland admitted they had been in talks, but stressed that they were 'inconclusive at the present time'. The press were unclear about why British Midland were in talks with Dan-Air, which, it said, was foundering because of the collapse in the package holiday market. Captain Alan Selby told us:

'Well they would say that wouldn't they? Dan-Air was a much larger airline than BMA. While the press were going on about them not being able to expand at Heathrow, they neglected to say that we had some very good routes out of Manchester, Newcastle and Gatwick. Our fleet was considerably bigger than theirs and our network dwarfed theirs. We carried six million passengers that year, two million of them on largely profitable scheduled routes. That was double those on BMA,. So, from my point of view it was obvious why they wanted us. If we had been making any mistakes in the late 1980s I believe that it was because we were diversifying into too many areas, we were also in the habit of keeping unprofitable routes going for far too long. Instead of just axing them. We did have profitable parts of the business, the engineering was profitable for most of its existence and so was Gatwick Handling. I also believe that a lot of the charter stuff should have been thrown out. It's perfectly acceptable to have a modern, efficient airliner flying good business, but I, and many others knew that operating the 727 came at a heavy price. I don't think they were making any money at all, and if they were not - then get rid of the jets and either replace them or operate the profitable ones only - using the most modern aircraft. I can't say for sure, but I believe that there might have been a bit of egomania in play. I think Dan-Air enjoyed being known as the second largest airline in the UK. But the bottom line was that anyone can have a shop selling ten pence apples at nine pence each. You can't do it for very long though. The charter scene had so much over capacity with new airlines all over the place. It was hard to get the contracts, you have to match all the new carriers' rates, and if you are doing that with a 727 and your competitor is using a 757, and you are using so much more resources on the same route - you will lose money.'

Within days the press was full of stories about how Dan-Air was about to be taken over by Air Europe, American Airlines or Lufthansa. Dan-Air were anxious to re-assure holiday-makers and the travelling public that it was 'business as usual'. Telling journalists that any talks they were involved in 'would in no-way jeopardise any contractual arrangements we have with any of our customers. We are a controlled company, in other words we have various family trusts and directors, who together, hold a majority shareholding in excess of 60%, so we are in control of our destiny.' It was rumoured that the airline was up for sale at £45 million. One of the senior management team told us, on condition of anonymity:

'Obviously, I was not involved in the actual discussions, but I was involved from the sidelines. The whole industry was in a pretty desperate state. The International Leisure Group and their airline, Air Europe, in public at least, did a good job of appearing to be able to withstand the economic forces that was exceptionally hostile to our business. During the year there had been war in the Gulf, involving two oil producing nations. This was bound to have an effect on fuel prices. It would also mean that travellers were anxious about flying in general. It didn't matter that the Gulf was a long way away, it did unsettle the travelling public. It is never good with a backdrop like that to have constant speculation that your company is about to be swallowed up. I can assure you that we were not, as it were, on the phone calling every airline in town and saying 'Will you buy us please?' Airlines do work together more than you would imagine and believe it or not, contacts are maintained. In this sort of scenario, there are discussions with banks, that are ongoing through the year. Several airlines may use the same banks. There are all sorts of formal and semi formal dialogues between these institutions. It was not as if we couldn't pay the electricity bills. Things at this time went on as usual. You cannot be perceived as cutting corners with standards as that leaves you open to other sets of accusations. The board were not sat there with their heads in their hands night and day. There was the business of running an airline and that is what we did. You never knew - maybe a huge contract was just around the corner and if it was, then you had to be seen to be professional and ready to meet the challenges. Some of the changes that were about to come, I was enthusiastic about - some not so much. Some of the things that new people did, I thought were the right call - and some were, frankly terrible decisions.'

On May 24th a packed Boeing 727 was racing down the runway at Manchester about to take off when an indicator in the flight deck alerted him that there was a fire in the jet's engines. Highly experienced pilot Captain Charles Nash brought the aircraft with 187 passengers on board to a halt on the runway, whilst at the same time issuing a 'Mayday' call to the tower. the aircraft stopped on the runway and Captain Nash was heard on radio saying 'I thought you had learned the lessons from the 1985 disaster.' In the incident Captain Nash did not know if there was a fire because the engines are at the back of the aircraft and he couldn't see them. Manchester Airport Operations said that the CAA had been asked to launch an investigation and that to comment would prejudice the inquiry. The tower stated that they could not see flames, only smoke and that fire services were on their way. The Captain was given a radio frequency to speak to the fire teams. Communications were lost and the Captain forced to re-tune to the tower.

Just one day later a company BAe146 suffered a burst tyre on take-off at Gatwick on a flight to Newcastle. The aircraft flew over the tower at Newcastle to see the extent of the damage, revealing that the starboard inner tyre had burst. Emergency services stood by as the airliner with a near full load of 72 passengers approached. The Captain landed the aircraft safely.

The nest day a BAC 1-11 charter flight from Palma to East Midlands landed and was informed by the tower that smoke was 'bellowing' from one of the rear mounted engines. The crew opened the rear air stair, smoke began to fill the aircraft and crew then decided to close the door, instructing passengers to exit by the front door. Several passengers chose to ignore the crew and opened over-wing emergency doors before clamouring onto the wing and jumping off. One of those passengers was a seventy year old woman who jumped off, breaking her ankle. The Dan-Air spokesman said:

'We checked the engine and there was no fault. We believe it was just a case of some oil dropping onto the hot engine and smoking. The wind must have been blowing in the wrong direction and took the smoke into the rear of the aircraft. So our crew very properly made the right decision in closing the door and instructing passengers to use the front door. There was no intention for it to be an emergency evacuation.'

Newspapers carried reports on May 26th that Dan-Air looked 'certain to be taken over by Lufthansa' A claim that was dismissed by Dan-Air with a spokesman saying: 'I don't know how many times we have to repeat this, but it is business as usual. There have been talks with other airlines about forming closer ties, this does not mean a take-over. We can't have a situation where every day the press announce another new airline is being lined up to take us over. Passengers have absolutely nothing to worry about.'

Inspirations East - a small Tour Operator chose to charter Dan-Air Boeing 737 400 series jets for a series of holiday flights from Gatwick to Goa in India. The flights would operate in 170 seat configuration and would be the first charter flights to India that Dan-Air had undertaken. There would be a refuelling stop at Sharjah in the United Arab Emirates. There would be a free bar and in flight catering. For an additional £95 passengers would enjoy extra leg-room seats and upgraded catering. The Sunday evening flights would operate from October through to March 1991.

Harry Goodman gave an interview to TV which was displayed a lot of his ambition.

'When we started as a small Tour Operator we soon realised we needed an airline, all the airline charter companies were owned by our rivals. So that was a necessity, after that, it became a fun business, it's very fun, very profitable. We like to win. We don't take great risks with the company, we take calculated risks, we like to be winners. You know it's fun to take on your rivals, and Governments and bureaucracies, and it's even more fun when you're winning.'

But winning hadn't come easy, Air Europe had started out as a charter company, carrying passengers for it's sister company Intasun. Not all of the charter airlines were owned by rival Tour Operators - Dan-Air for instance. It was only five years prior to this interview that Air Europe had gone into scheduled services, challenging the larger airlines head to head. Goodman continued;

'What you have got is a series of not likeable, fat cat European scheduled airlines. They have never had to face competition, their costs are sky high, and in a competitive environment they are finding it difficult. Now the only way that they can compete is by blocking facilities. Refusing to accept our tickets, refusing to inter-line, refusing to enable us to use facilities at airports, but we're cracking all of those.'

They claimed that the strategy was simple, that Air Europe were using brand new aeroplanes and offering an excellent on-board service for a much lower price. They said that established airlines fought tooth and nail to block the new upstart and Air Europe found themselves handicapped at every turn. Including denying them access to the European computer reservation system. Charles Powell, Air Europe's Scheduled Services Director said:

'We still have an outstanding issue with Alitalia who have been editing data that we want to put into those reservations systems. They refuse to show our fares for example. They pretend that we charged the same fares as Alitalia, all that kind of nonsense. All of that can be very damaging and it has the effect of reducing the consumer's choice in what is, otherwise, a developing market.'

Most airlines airlines had traditionally expanded cautiously, but Air Europe had a different approach. In 1989 they began to form partnerships with smaller airlines all over the continent, establishing a pan European network of scheduled routes, calling the concept 'Airlines of Europe'. This bold step saw the entire European airline industry watching their every move, but Air Europe were absolutely convinced that the next decade would be theirs for the taking, with Rod Lynch, Air Europe's Managing Director going on to say;

'The biggest barriers are the barriers in people's minds, about those people who see France as a totally foreign country, as opposed to somewhere that is around one hours flying time away. I think this country, which is very insular, is going to go through something of a revolution. The sheer access into Europe, and vice versa, is going to generate masses of traffic, and I fully intend that we are going to take advantage of those.

But as the market changes, so do the airlines. The next few years would see partnerships from some of the largest airlines in the world, with huge resources. Was Air Europe not worried that they might simply squeeze them to death Goodman said;

'Well they will try, but one thing is for sure, you don't gain anything by putting a series of inefficient companies together. You know, if you look at our costs compared to Air France, Lufthansa, Iberia even British Airways, our costs are 40% less. To get low fares, you have to have low costs, and all the cosmetics of putting all the monolithic giants together without addressing the basic problem of getting the cost base down will do them absolutely no good whatsoever. We compete every day of the week. If you look at how scheduled airlines have grown up, they have grown for instance, between British Airways and Air France with an agreed affair between London and Paris. There was no competition, the fare was agreed at which was the least efficient of those two carriers, so you didn't have to worry about costs, you know, if Air France had a strike and the unions wanted 30%, it was like 'no problem give them 30%' because who pays? You and I, the poor old passenger. But now that's gone out of the window, so they've gotta look at costs. But they've got a cost structure that's built up over twenty years as a monopoly. Very difficult to get rid of.'

Air Europe had made their mark at Gatwick. They were the second largest airline at the airport, behind Dan-Air, both were ahead of British Airways. In 1989 Air Europe had carried more than three and a half million passengers. Their business class and executive lounge, 'Premier Class' had been a hit with business commuters. Rod Lynch said;

'The airline business is absolutely infectious, once you've been bitten, it's completely incurable, I couldn't consider working anywhere else personally. I don't know any of my co-directors who would give tuppence to work in any other industry. Once you are in aviation it tends to stick permanently.'

Harry Goodman closed by saying;

'If you're asking me do I like flying? No, I hate flying, but that's a personal thing, I just hate getting on aeroplanes, on saying that, I do 200,000 miles a year, so I have to. But it's certainly not in my blood, you know, I don't fall in love with an aeroplane sitting there on the tarmac. I like to be successful, I like to take on challenges, I like to win, and here you see an opportunity, which is very rare a man gets. I was told at first, you will never get a scheduled service licence, and if I did I would't get the landing slots, and if you did, you would never get lower fares - we got all three. We run at satisfactory load slots, and if I look at our major competitors, they are more frightened of us than I am of them.

Sir Colin Marshall Chief Executive of British Airways said in response to Goodman;

'Well I think he will have another thought in due course. I saw him on the video, and there was, of course, a sprinkling of disinformation and half truths. It's hard to conceive that Harry's costs would be 40% lower than those of British Airways, after all, we buy our aircraft at the best possible prices on a high volume basis, we borrow money at a fine interest rate. We pay our pilots and engineers at a proper rate and I very much doubt that Harry is paying his pilots and engineers at 40% less than British Airways. I doubt that his insurance is less, and I know that his air traffic control and landing charges certainly won't be less than ours, so I think that Harry and we are going to be very strong competitors for the future, and that's a good thing..'

Marshall denied that there was any attempt by British Airways to squeeze smaller airports out of business by pointing out that Air Europe had more slots at Gatwick than British Airways and their charter carrier Caledonian combined. He neglected to say that Air Europe had no slots at Heathrow.

A baffled elderly couple were back in the UK on June 1st after setting off for a holiday in Norway and landing in Greece. Retired Pit official John Matthews aged 83 and his wife Jane aged 82 were looking forward to their usual holiday in Norway. But while their luggage was loaded on the Dan-Air flight to Oslo they were being ushered onto the flight to Lesbos, and five hours later instead of gazing at snow capped mountains they found themselves in a Greek hot-spot. Mr. Matthews of Sheffield said: 'We saw two Dan-Air planes side by side and we got on the first one.' The mistake came to light after the Greek bound aircraft took off and officials became aware that their Oslo flight had only 29 passengers on board instead of the 31 who had checked-in. The bemused Captain radioed saying he had two extra passengers, but by that time it was too late. Dan-Air put the two up in a hotel and flew them home to the UK. They would then fly to Oslo where the time lost would be made up at Dan-Air's expense. Mrs. Matthews said: 'We can't be angry at anyone at Dan-Air, they have been so good to us. In fact, Greece looked lovely,we are thinking of going there later in the year.'

In June, a Tour Operator conference spoke about how 1991 would see fewer holidays available. Prices would be fixed through a background of heavy losses, reduced demand a fewer aircraft. A total of 25 aircraft had been lost following the collapse of British Island Airways, Paramount Airways and the closure of Novair.

Air investigators began a probe on June 22nd into an air-miss involving a Dan-Air BAC 1-11 and a British Airways Boeing 747 over Sussex. A Dan-Air spokesman said 'Both aircraft were under the control of London Air Traffic Control and our pilot had been instructed to descend immediately to avoid collision with the British Midland aircraft. The CAA said they had referred the matter to the Independent Join Air-miss Group.

On June 24th another air miss was reported over Wales. The incident involved a company Boeing 727 with 170 passengers on board flying from Ibiza to Manchester and a Dublin bound British Midland Boeing 737 from Heathrow. The two aircraft narrowly avoided disaster at 28,000 feet over mid-Wales. The Dan-Air 727 took a dramatic dive to avoid a catastrophe. The two Captains prepared reports which would prove vital for the investigation. CAA said radar tapes would be studied to help find a solution. The two incidents came only days after a new computerised system had been installed to help cope with the increased Transatlantic flights. One of the major corridors was north of Swansea where up to 250 flights a day passed.

The airline said they would 'look again' at their decision to scrap the mid-morning flight from Inverness to Gatwick from October. Company Chairman Fred Newman promised to 'carefully reconsider' the move after pressure from Inverness M.P. Sir. Russell Johnston. The 1105 flight is one of only five daily air-links to London and is used mainly by businessmen from the north. Sir Russell said losing the flight could potentially cause damage to businesses and tourist prospects. Sir Russell said he very much welcomed the 'constructive approach' of Mr. Newman.

A furious row between a man and his wife sparked a mid-air alert on July 3rd. The couple started feuding shortly after take-off and five miles in the air, senior stewardess Annie Ball tried in vain to calm the couple down. But their noisy bickering carried on over Spain, France and across the English Channel. Passengers complained that the arguing was louder than the engines. As fellow travellers watched on anxiously the Captain, Graham Harradine vainly appealed for a truce. Then Captain Harradine radioed ahead asking for police to deal with the matter after landing the BAC 1-11 at Manchester. But just before touch-down the insults suddenly stopped flying. The row was over and the two police officers who went on board the aircraft to speak to the couple took no further action. The Airport Police Liaison Officer Ken Bettanay said: 'Holidays can be a testing time for couples.'

The incident was reported as a 'domestic situation on board'. The plane, from Alicante had 119 other passengers on board, including two infants.An airline spokesman said: 'In cases like this, the normal procedure is for the senior stewardess to try and calm things down, and if that fails the pilot is normally asked to talk to the passengers concerned.'

On July 11th an investigation was launched after a man travelling to Athens from Manchester Airport boarded a Dan-Air flight destined for the Canary Islands. It was the third time that a Manchester passenger had ended up on the wrong plane at the airport in six weeks. The man was put up in a hotel and boarded a scheduled services flight to Tenerife the next day, all at the airline's expense. The man had been flown back to Manchester on the return flight of the one he had boarded, he had a night at the airport hotel and flew to Tenerife the next morning. Britannia Airways had a similar mishap when a passenger boarded a Boeing 767 which was parked next to a Britannia 737. Monarch Airlines had an extra passenger to Turkey who should have been travelling to Ibiza, British Airways had a Milan passenger end up in Dublin and perhaps the worst example was when an Arab business man who should have boarded a KLM flight to Amsterdam, ended up on an Air Malta flight to Malta. Dan-Air said: 'It appears there has been a mix up on two occasions when gate staff have not supervised boarding adequately. But our cabin crew are instructed to check all boarding passes, as well as more than one crew member carrying out a head count before push-back. We will be fully investigating this matter.' Meanwhile, airport official at Ringway said: 'The problem of passengers getting on the wrong aircraft unfortunately does happen from time to time.'

Gatwick Airport upheld a ban on extra late night flights which had been imposed in 1988, following complaints by local residents and local environment groups. The Government ruled out additional flights for the foreseeable future. But the decision was condemned by airlines who used quieter aircraft types, who's noise levels, they said, were well below maximum noise thresholds. The restrictions had been imposed by the Department of Transport with a promise to review the situation after two years. Minister Patrick McLoughlan said that noise levels in the area had been greatly reduced since the introduction of the restrictions, and that the latest category of quiet aircraft show that the overall night noise climate can be improved. But he still refused to life the restrictions and ordered a two year research programme into how people's sleep was affected by aircraft noise at Heathrow, Gatwick and Stansted. Representatives from the Airports would sit on the committee. Gatwick Airport Consultative Committee agreed that it was not the right time to review the night quotas. The members suggestion of a survey of local residents be carried out was taken up by the Minister. McLoughlan said that an integrated noise and track system would be in place at Gatwick by 1992. As older, noisier aircraft are phased out, to make way for newer, quieter models, the amount of disturbance from aircraft noise should be reduced he said.

But Air Europe acted angrily at the decision, saying: 'At Air Europe we feel that those airlines like Dan-Air who operate noisy old aeroplanes should be penalised rather than companies like ours who have invested in new, quieter aircraft.'

A Dan-Air spokesman said: 'We are disappointed at the news, but not dismayed. We are buying quieter aircraft.'

A substantial portion of an unused hanger at Manchester was taken over by Dan-Air in July for their servicing and inspection crew. Local electricity firm Norweb had installed new state-of-the-art quartz ray heaters for what was the largest heated area of its kind in the UK. The installation,although costly vastly improved the electricity efficiency in the company with 50% of capital costs recouped within 15 months.

Above: The Quartz Ray Heaters at Manchester

Dan-Air were the recipient of the Tea Council's 'Best Airline Tea' in the world. They were chosen with a combination of presentation and leaf blend. The council flew 300,000 miles over 504 hours sampling the tea of airlines all around the world. Eventually a short list of thirty airlines were chosen, this was narrowed down to Austrian Airlines, British Airways, American Airlines and Dan-Air. Two professional tea tasters then selected the winner. Dan-Air said 'Of course we are delighted to have won this award and that our passengers can enjoy the brew, from the judges point of view, Dan-Air is obviously their cup of tea.'

Dan-Air were keeping the blend a secret, but it was believed to be a blend of Indian tea. The judges also felt that Dan-Air crew serving the tea with milk from a jug was also a factor int he taste, with the Dan-Air spokesman saying: 'I think they were impressed that we serve milk that way, not from a carton or a plastic jug and certainly not the little packs of UHT milk.'

One of the tasters, Jenny Wright who had travelled 80,000 miles tasting tea was also impressed with the enthusiasm of the Dan-Air cabin crews. She said 'Tea is undoubtedly my favourite drink, and whilst I am no expert, I know what I like.'

Services between Aberdeen and Manchester/Gatwick were to be stepped up to four return daily flights from the end of October, increasing frequency to 24 flights a week. There wold also be an extra one flight each way on weekdays to Manchester. Weekends would remain unchanged. At the time there would be increase in the number of seats available on the Inverness-Heathrow service which would see an increase of 600 seats a week following the introduction of the 104 seat BAC 1-11 500 series. Services from Inverness to Gatwick via Aberdeen and Manchester would be suspended from October in the light of the anticipated reduced demand on the route during the winter.

Dan-Air had issued a statement: 'The Inverness Member of Parliament Sir Russell Johnston had asked us to look again at the services, and we have. At present, only 7% of our Inverness passengers have opted for Gatwick. It was felt that the service could not go into profit if we took into account the very high landing and parking charges at Inverness. There isn't enough business to justify the service without landing at Aberdeen and Manchester, and the figures there are not high enough to sustain the service through the winter months. We will look once more at the service in the spring.'

But Inverness Airport bosses disagreed. Hugh Lawson denied that the airport fees played any part in the shutdown. 'Fees at Inverness are substantially lower than at Aberdeen or Gatwick.'

A near-miss involving a Dan-Air BAC 1-11 and a NATO F111 over Inverness in November 1989 had been kept hidden from the public a Scottish newspaper revealed. The bomber was carrying out a 'mock bombing attack' over Inverness Airport. The incident caused so much concern that the US Air Force was now questioning whether these tests should be carried out over civilian airports. Several F111 pilots had refused to carry out the practice that day, but the leading F111, travelling at 417 mph, and whose 'target' was on the periphery of the airfield, passed the Dan-Air BAC 1-11 on final approach, at a speed of just 108 mph, just yards apart. The Dan-Air pilot complained on the radio, saying: 'Not impressed with that fighter.' That jet went right over the top of us as we were just rounding out there. Are they supposed to do that sort of thing?' The controller replied in the negative. The pilot was of the intention that the move was carried out intentionally so as to give a close miss. This was backed up by the controller who thought the pilot of the F111 had 'aimed straight at him'. The pilot estimated that the F111 had come within 250 feet, but the controller said the distance was just 33 feet. The investigation by the Civil Aviation Authority air-miss working group said the discrepancy was 'hard to explain'. The report went on to claim that if the BAC 1-11 had been later in landing because of any hold-up the outcome could well have been very serious. Although the report had great sympathy with the controller, it say the final clearance given to the F111 to approach the airport, given that they were just two minutes away, put them into conflict with the Dan-Air flight. The controller had apparently thought the BAC 1-11 would be on the ground by the time the US war planes arrived. The report recommended that 'the undesirability of practice attacks in UK civilian airfields without proper clearance should be brought to the attention of NATO Taceval (Tactical Evaluation)' But it also notes that US Air Force opinion that 'the use of civilian airfields for practice aircraft should be discontinued.' The Captain noted that: 'It is not for us to say whether these flights should be carried out within civilian airspace or at civilian airfields, but they should never be carried out without the express knowledge and consent of pilot of the civilian aircraft. We in the flight-deck had absolutely no warning. We were unaware that such practice flights were being carried out in the area. We were not told anything at all during our approach. As far as we were concerned, we were on a standard approach, which requires a great deal of concentration at such a critical time. To look up and see a military jet heading directly towards us was terrifying. Our passengers had no knowledge of this and had certainly not agreed to take part in such tests. Who would have been to blame if we in the flight deck had reacted differently and made a catastrophic error? Members of the public who are ordinary fare-paying passengers should never be exposed to this sort of testing. Thank goodness we in the flight-deck were the only ones who saw what happened.'

A report issued several weeks later decided against stopping practice sorties at civilian airports but agreed that none would take place without the written consent of an airport manager. Sir Russell Johnston, the local M.P said he thought the report to be unsatisfactory. He said as far as he was aware these sort of missions were only to be carried out if six weeks notice had been given. He also called for the NATO pilots to face disciplinary proceedings.

A bereaved man told of his disgust at a major airline for losing the body of his 21-year-old brother, who had been killed in a checkpoint accident in Ulster. The family of Scots Guardsman Paul Brown went to Inverness Airport, Dalcross, on Saturday August 4th to receive his body off a Dan-Air flight. But they learned the coffin had been lost because of a blunder by cargo handlers. Paul’s brother, Allan, said: 'We just couldn’t believe it was happening. One of the Dan Air staff at the airport told us that he didn’t have a clue where Paul was, but that he would phone round a few place to see what he could find out. It was horrible. They seemed to be treating it as just another piece of lost luggage, not the body of a 21-year-old soldier.' After making inquiries, Dan-Air told the family the body was still in Ireland. But when the Browns contacted the Army for more information, they were told the coffin had definitely been put on a Dan-Air flight and they had the documentation to prove it. After a tense hour of waiting, the family learned Paul’s body had been found stranded at Gatwick Airport. Allan said Dan Air told them the body would have to stay there until arrangements could be made to fly him to Inverness on Monday. 'My Father was furious - disgusted at the idea that his son would have to lie alone in a cargo hold for two days.' He said. But Dan-Air decided that they would fly the body to Glasgow that day and transfer the coffin by hearse to Inverness. Allan said: 'As a mark of respect, and to make sure no more blunders took place, Paul's Uncle, who lives in Glasgow, met the plane and carried the coffin off themselves. The airline's handling of this was totally insensitive, they just didn't seem to care.'

On August 24th Davies And Newman share price suddenly fell from 175p to 150p a fall of 12% knocking £12 million off the value of the company. But a company spokesman said: 'Things are proceeding as normal. Absolutely nothing is happening at all - we are baffled by the speculation.'

Speculation about the airline's performance had been rife with analysts predicting that high fuel costs and the decrease in the number of package holidays being taken were to blame. The airline had been rocked by the setting up of an in-house airline for the fourth largest Tour Operator in the UK, Airtours, who were about to launch Airtours International. The new carriers would certainly have a negative effect on Dan-Air's charter sales. Airtours said that their new airline would operate 60% of their summer 1991 season and 90% of the winter programme. The charters that Dan-Air provided for Airtours was the equivalent of five aircraft that had been committed to Airtours. The top four Tour Operators in the UK now all had their own airline. The Dan-Air spokesman denied that recent talks with the CAA had been a 'crisis meeting' saying: 'It was a perfectly normal meeting that the CAA have with all airlines every year to keep them informed of their future plans.' The present share price compared with a price of 934p the same time a year before. The share price eventually recovered to 225p.

Davies and Newman Chairman Fred Newman said he believed that the fall in price was a result of press speculation and a result of minimal trading volume. He confirmed that the company was involved in talks with a number of airlines and was in the process of conducting a review of company operations. The process had begun with the news that the main company office was moving to Gatwick and that five aircraft would be sold. The review would not see any changes to the airline's scheduled operations in Scotland. For the first time, media reports claimed that Richard Branson's Virgin Atlantic was interested in Dan-Air. Captain Alan Selby told us:

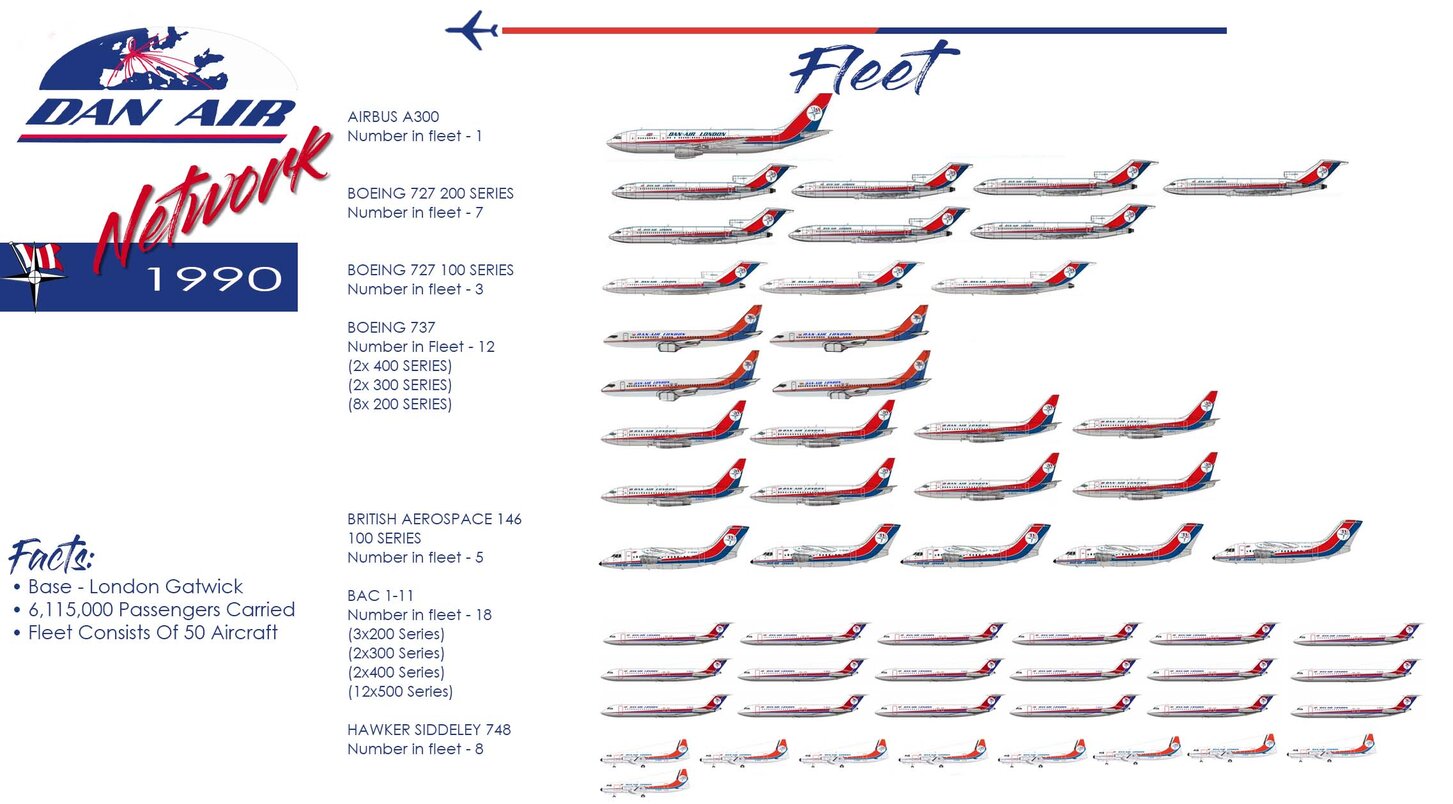

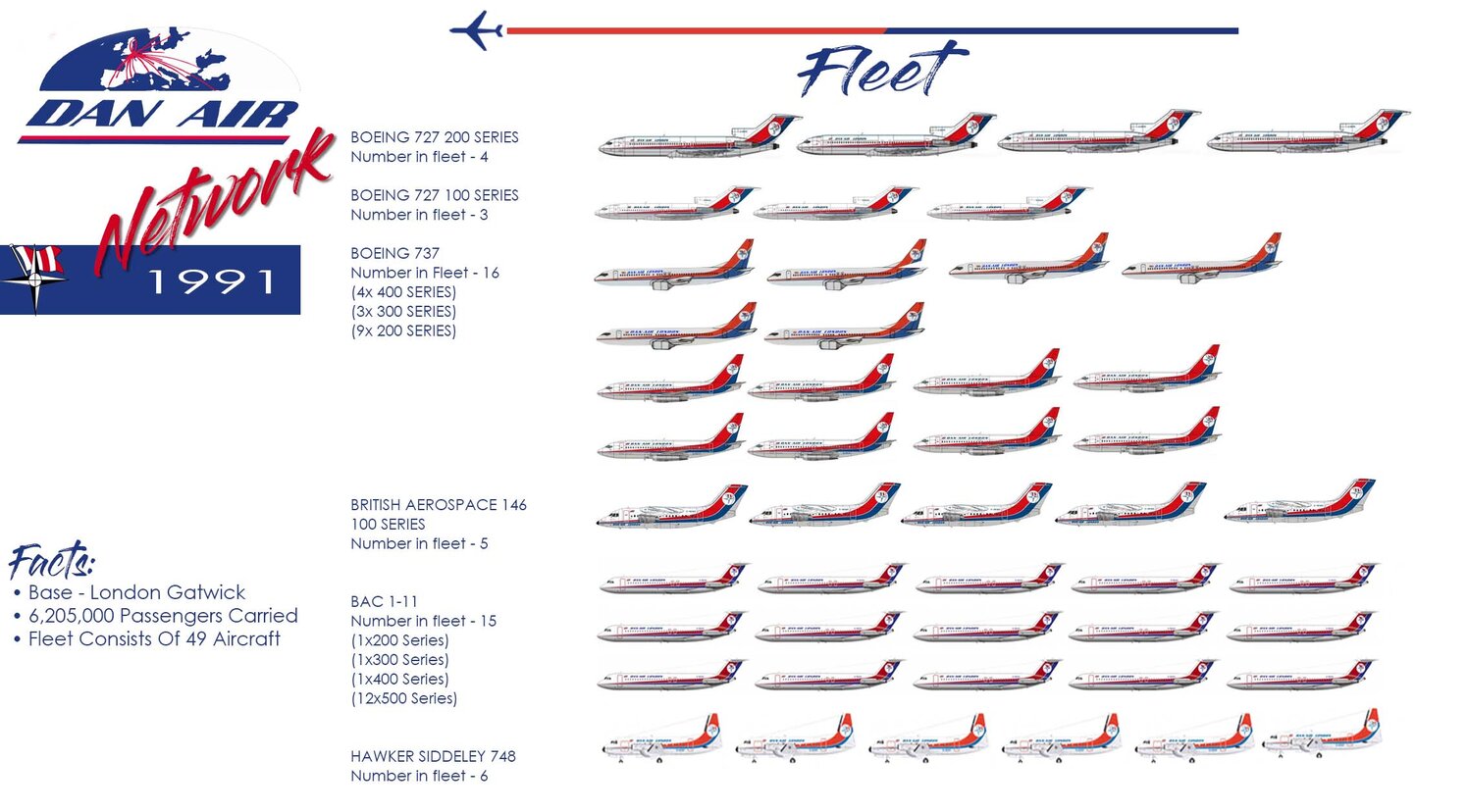

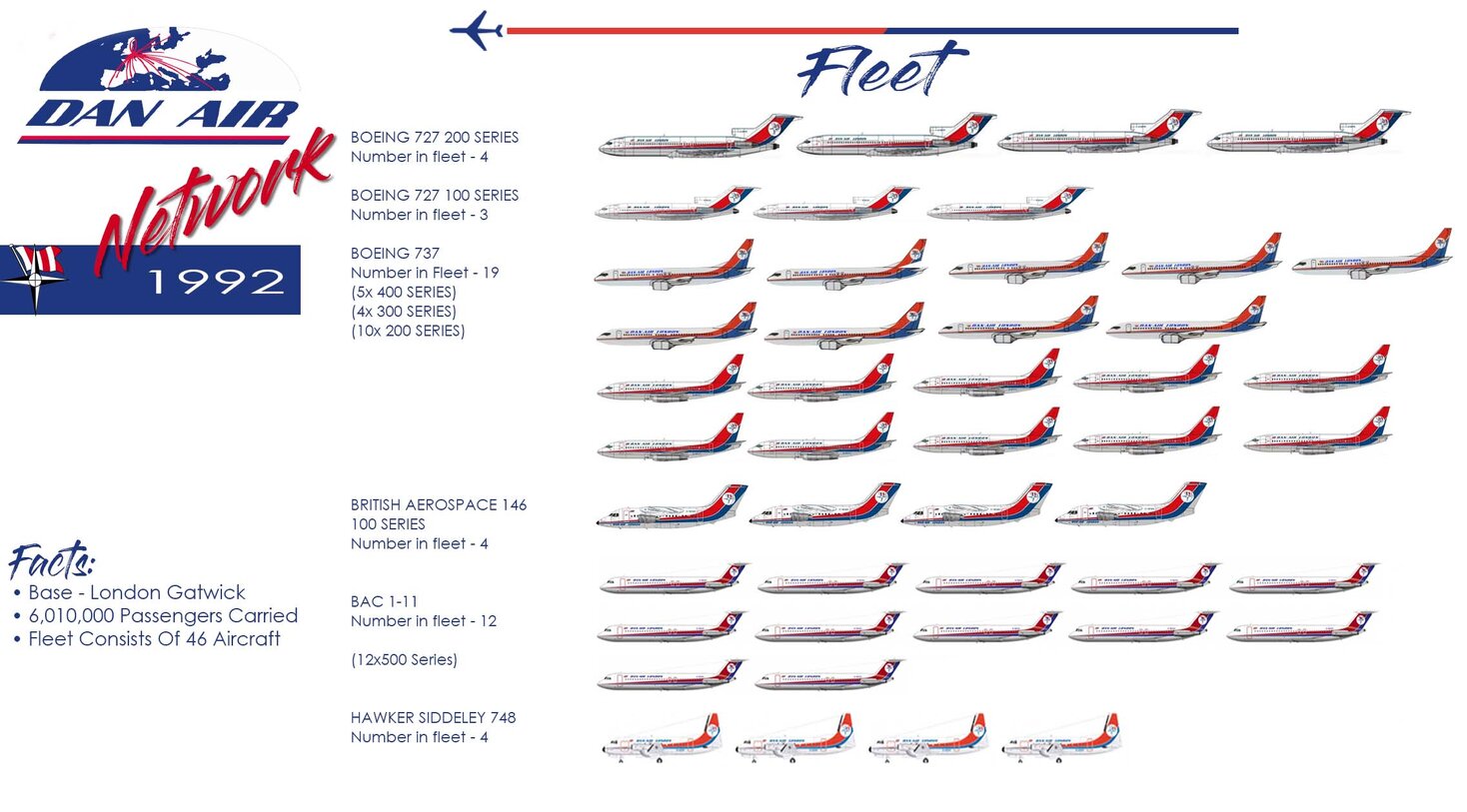

'The review of company operations was vital I felt for all the reasons I mentioned earlier. What was as clear as a bell was that five aircraft would be joining Airtours fleet very soon with roughly the same capacity as the 727. In the end, a lot more aircraft went than I expected, and more joined the fleet than I thought would. My own notes read that the last of the A300s went, and three of the 727 200, we got rid of one each of the BAC 1-11 200/300 and 400, whilst keeping all the 500 series. We disposed of two HS 748. On the plus side we bought four Boeing 737s. So we were five down. Lots of activity was going on, which gave the impression that 'something' was afoot. I didn't like that atmosphere. But there was never a feeling that we would become part of an airline much smaller than us. My colleagues and myself always had an unshakeable belief that we would somehow get through it. We always had before, no matter how big the problems we faced were. I certainly agreed with Fred Newman that press speculation was impossible. Mainly because so many of them didn't understand the airline business and were just looking to write something that had an attention grabbing, gloomy headline.'

The review did indeed see many changes. Up to 150 staff would move from London to the Newman House complex in Horley to be nearer Gatwick. The recent fuel price hike would effectively add £1 per passenger, per hour on a Dan-Air flight. The poor efficiency of the BAC 1-11 2/3/400 series and the Boeing 727 had further hampered the airline. The base at Stansted looked certain to close as Airtours had made it known that their own airline would operate 60% of Airtours' summer programme and 90% of their winter one. The sale of the aircraft would bring in new revenue and the replacement aircraft would all be leased in and not purchased outright. The UK economy continued to struggle and by September two more airlines had folded, Capital Airlines and Air Dundee both went bankrupt.

September 15th saw a company BAe 146 en route from Manchester to Gatwick come face to face with a group of hang-gliders. The aircraft had climbed to 4,500 feet over Leek when the Captain noticed several gliders. Although the gliders were well below the height of the gliders, it appeared that the aircraft had flown directly through them. A company spokesman said: 'The pilot did not have to take any evasive action as he had passed through the group. There are no air traffic regulations for hang-gliders, but it is their responsibility to ensure that the area they are flying in is safe. There would considerable turbulence to a hang glider who flew into the trails of a four engine jet aircraft. Not to mention the unthinkable if they were to be in the direct line of an aircraft travelling at more than 400 miles an hour. Leek is quite near to Manchester when one is in an aircraft. Fortunately nothing happened..

It was revealed on September 18th that the company was planning to sell the Dan Air Engineering division in a deal that was believed to be worth £25 million. Parent company Davies and Newman confirmed that they had asked Merchant Bank Barings Brothers to contact potential buyers. The sale would include the recently opened £10 million hanger at Gatwick, the main Lasham Airfield, the Manchester base and eleven sub station engineering divisions. More the 1,600 people worked for Dan-Air Engineering and the company had been consistently profitable. Many people could not understand the decision with one former DAE manager telling this site.

'We never saw it coming. We had just signed a huge maintenance deal with Air Europe, and we had more than 100 aircraft that we maintained, besides our own fleet. We were pretty much fully engaged at all the bases. Besides which, we had recently made a sale of extra spare parts we held and that had raised a few million. If any part of the Dan-Air group was failing to make money, it was the charters. We didn't produce our own figures for the PLC thing, we were just one of the companies within the group, but it was widely known that we were profitable. I read about how much it was going to be sold for in the press and it didn't add up to me. £25 million....When the spares we sill had were worth about £10 million. That hanger at Gatwick was surely worth more or less what it had cost - and a fully functioning base at Lasham with its own runway! We had every bit of plant you could ever need. It was a bargain in my opinion. A bit too much of a bargain.'

A Davies and Newman spokesman said of the company: 'As part of our previously announced review of corporate strategy we have decided to seek expressions of interest in all or part of Dan-Air Engineering from parties capable of providing the resources to enable to division to achieve its full growth potential. The division employs a total of 1,625 people. Dan-air Engineering made a profit last year against a a turnover of £50 million. The division maintains our fleet of 51 aircraft and in the last year alone has serviced aircraft for more than 30 airlines. We plant to retain a 20% stake in the company which will continue to maintain our own fleet of aircraft.'

Analysts were predicting that Dan-Air would make a loss of £30 million this year, amid speculation that airlines were now reviewing their air charter links with the group. By September 18th shares fell 130p and stood at 205p. This bad news came at a time when it was announced that the company had carried a record number of scheduled service passengers during the first six months of the year. A total of 840,000 was 14% higher than the same period on 1989, with the business class 'Elite' showing the largest growth. This success in the scheduled field contrasts with the slump in charter traffic which was hitting all sectors of the travel industry. Dan-Air had a record turnover in 1990 of £380 million but by August fuel prices had rocketed again.

Charter flights were arranged to Sweden and Finland this year, when a record 17 flights would depart from Manchester on their way to see Santa.Scheduled flights from Newcastle to Amsterdam would be extended through to Berlin from October this year. The flights would be undertaken using BAC 1-11 aircraft.

There would be work for engineers on September 18th when a company Boeing 727 with 187 passengers on board suffered a tail strike on take-off at Manchester Airport on a flight to Tenerife. The aircraft (DA2726) returned to Manchester where passengers were put up in a hotel. Repairs were carried out at the airport and the aircraft took off for its destination 10 1/2 hours late.

Two passenger jets avoided a disaster over Hertfordshire on September 26th. a Dan-Air BAe146 jet from Gatwick to Newcastle with 74 passengers on board was forced to climb steeply to avoid a collision with a Scandinavian Airlines jet with 105 passengers. SAS said the aircraft were less far apart than the 300 metres safe minimum distance, but denied they were 90 metres apart. A Dan-Air spokesman said Captain Ted Espir was forced to take 'instinctive action' at 15,000 feet. 'He pulled back the stick sharply and went into a steep climb, passing 200-500 feet over the SAS aircraft. The CAA confirmed an air-miss has been reported and that Air Traffic Control had given avoiding instructions and the SAS passed below the BAe146.

A company pilot flying one of the BAC 1-11 fleet scraped the wing on the runway as he landed the jet at Inverness on October 15th. The un-named pilot was making a blind instrument landing due to low cloud on September 29th. The aircraft was grounded for 48 hours while repairs were carried out. Dan-Air said: 'The pilot was a very experienced pilot with no blemishes on his record. He is back flying again after losing his seniority.' An airport worker who witness the incident said: 'He really was lucky, if the wing tip had hit the soft ground at the side of the runway instead of the tarmac, the aircraft could have quite easily overturned.'

A further incident came occurred in October when two RAF Tornado jets sandwiched a civilian Dan-Air Boeing 737 on a flight to Kos. A Dan-Air spokesman said that both military jets passed within 500 feet of the 737 in a high-risk incident that forced the pilot to bank steeply. The double miss happened on Wednesday October 10th, the day after the Ministry of Defence announced the results of an enquiry into the January collision between RAF Tornado and Jaguar jets near a Northumberland village 12 miles away. The incident occurred minutes after the Boeing, carrying only its crew of seven, took off from Newcastle Airport to fly to the Greek Island of Kos to collect passengers. The spokesman said: 'Pilot, Captain Roger Jackson was climbing through 14,000 feet when Newcastle Air Traffic Control advised him of possible 'pop up traffic' below. At that moment he saw navigation lights of aircraft coming towards him on what he thought was a collision course. So he banked very steeply for an aircraft like a Boeing 737 and switched on all the lights to fully illuminate it. In view of the instructions given by Newcaslte Air Traffic Control, we suspect the RAF pilots were where they ought not to have been.'

Berwick M.P Alan Beith claimed the RAF jets should not have been in the area at all. But the following day a Ministry of Defence spokesman would not comment on whether Tornado jets were allowed in the area. He said the incident would be fully investigated by the independent joint air miss working group.

The very next day a company BAC 1-11 reported an air miss with two gliders in an unrestricted area of air-space over Aviemore. The BAC 1-11 with a crew of six and 68 passengers on board was climbing at an altitude of 10,000 from Inverness to Heathrow when it passed 500 feet over the two gliders. although no evasive action was needed the pilot had reported a small blip on his radar.

The Civil Aviation Authority said it would investigate. At the same time Dan-Air rejected claims that their pilots 'sometimes took unofficial short cuts' on flights between Inverness and Glasgow. Airline spokesman Peter Clegg was responding to allegations made by Cairngorm Gliding Club instructor Alan Mossman who said that Dan-air were well known for diverting from their proper routes.

Mr. Clegg said there were no mandatory air corridors for the Central Highlands for commercial aircraft. 'Although they are not legally restricted, our pilots always follow instructions given to them by Air Traffic Controllers. We don't blame the gliders for this incident, they are as entitled to use the air as much as anyone else. Legally the gliders can fly anywhere they like because it is not controlled air-space, it is in nobody's interest if the situation remains unresolved. Whilst we accept that it is more dangerous for the glider pilots than for our pilots, because in a near-miss the gliders could be in trouble because of the turbulence caused by an airliner, you never can tell. Clipping a glider can have an equally bad effect on a large jet.'

The area concerned was well known by gliders, who crossed the A9 road near Loch Garry. the gliding club the gliding club was at Fishiebridge Airfield near Kincraig where 15 gliders were kept. Mr. Mossman said that Dan-Air jets regularly overflew the airfield, sometimes 'directly'. 'The majority of Dan-Air flights into Inverness take a short-cut through unprotected air-space instead of using the air route provided for commercial aircraft. By flying into uncontrolled airspace where no separation from other aircraft can be guaranteed, they put passengers and other aircraft at risk - all to save a little time and some expensive fuel. Their complaint about gliders being dangerous and difficult to identify is over the top. We really have been slagged off for no reason at all.'

Mr. Clegg said: 'Perhaps some of our pilots are unaware of the location of the gliding club, but I know the manager of our BAC 1-11 fleet is going to discuss matter with Mr. Mossman. It is not in anybody's interest to leave matters as they are. Next time it could be a gliding club from Deeside, or a club from way outside the area that gets involved. Something has to be sorted out. Hopefully the joint air miss working group will consider this when it gets down to examining the detail.'

Davies and Newman promised to clear the air over speculation about the company. They said they would issue a statement “as soon as possible”. Press speculation throughout the two previous months had reached fever pitch with rumours that one of the City’s toughest troubleshooters, Mr. David James, was poised to move in to run the airline as part of a two-year plan. The stories that circulated hinted that bankers were insisting on top level management changes in the company as a condition of guaranteed backing. Davies and Newman issued a statement on October 18th which said, they would be 'making a statement concerning the company’s plans and prospects as soon as possible”. Shares in Davies' and Newman, which had plunged in the wake of previous Dan- Air speculation, were unchanged on October 18th at 140 p. This compares with a high this year of 760 p

Angry passengers on a flight from Gatwick to Aberdeen which was delayed for five hours on October 18th were demanding an explanation for the disruption. The flight had to be aborted when it was two-thirds down the runway on its take-off. Weary travellers, who were due to leave London at 11am, were asking why the flight was allowed to go ahead initially, when the plane was known to have faulty equipment. Passengers were informed minutes before the plane was due to take-off that the pilot had become aware of a faulty gauge on the plane. But they were left stranded for more than an hour while engineers checked whether to let the flight proceed or to call in a replacement aircraft. When they were eventually given the go-ahead to depart at 12.10pm, the flight had to be aborted when the fault recurred. However, the problems continued when passengers were transferred to a replacement plane, only to find that one traveller had left, and an hour long baggage search had to be carried out. Exhausted travellers on the packed flight which contained a higher proportion of children than normal eventually made it back to Aberdeen at around 6.15p.m. One Aberdeen passenger, Mr John Marshall, admitted the aborted take-off was 'quite scary' but said most passengers realised what had happened. He said: 'The feeling among most people was that the captain had done the right thing, but he should never bad been put in that position in the first place.' A Dan-Air spokesman last night apologised for the 'excessive delay', but said it could not have been avoided. He said: 'It is obviously far better to be safe than to fly to Aberdeen and have to shut down one of the engines. It’s just one of those mechanical things—we did our best.' The spokesman said the problem arose when a gauge on one of the plane’s four engines showed it was using an excessive quantity of oil. He said engineers had investigated the problem and decided the plane could depart. But during take-off the gauge was still showing high oil consumption and 'the pilot decided not to risk it any more.' The spokesman said the delay could have been avoided if the passengers had been transferred to another plane when the fault was first noticed, but said that another aircraft and crew may not have been available at that time. He admitted the plane had had the same problem before and said: 'The mechanics thought they had put it right and cleared it for this flight.’

City troubleshooter David James was announced as the new Chairman of Dan-Air on October 19th. His appointment which came with a rumoured salary of £30,000 per month, would guarantee the bank's backing until at least the end of 1991. Dan-Air had been profitable in every year of its existence until 1990. Fred Newman, Chairman of Davies And Newman would step down to make way for James, known in City circles as 'company doctor'. James was Chairman of Eagle Trust, a position he held when he was brought in as part of a rescue package. He would continue as Chairman and Chief Executive of Eagle Trust. Davies and Newman shares bounced up 15% ending at 155p on the news that James would become Executive Chairman on November 1st. James said:

'Most of the company's employees would keep their jobs. My appointment does not mean a threat to the established regional routes. I have no pre-conceived ideas about closing off any of the routes. One has to look at profits, you cannot go cherry picking and just keep the best routes, you have to look at the total.'

It was also revealed that the company was no longer up for sale. Earlier this year it had been speculated that a merger between Dan-Air and another airline was on the cards. But' Dan-Air Engineering, is still up for sale, with good progress being made.= with potential buyers.' said James.

A profit warning came with the news, results for the first half year to June 30th were expected to show a substantially larger loss than the £7.662 million for the same period in 1989. As part of the package, banks would boost the working capital from £40 million to £70 million. The credit limit was extended from the end of the month to the end of 1991. The Davies and Newman family, who owned 60% of the company agreed to suspend their voting rights while David James was Chairman. James said:

'I am encouraged at Dan-Air's present performance in having acquired 85% of its charter capacity for the 1991 season.

Dan-Air disclosed interim pre-tax losses on October 27th. They showed losses of more than double of those of last year. Losses for the six months to the end of June totalled £18.7 million compared with £7.7 million for the same period last year. Retiring Chairman Frederick Newman blamed rising costs, aircraft over-supply and fewer people taking holidays. At the operating level, Davies and Newman made losses of £2.2 million compared with a profit of £8.7 million the last year. Shares were cut by 35p to 115 p, wiping £2.5 million, or 23% off the company'’s stock market value. On top of the operating losses, the group had to weather aircraft hire charges of £6.7 million, depreciation of £5.6 million, and interest charges of more than £5 million. There is no interim dividend. The company said on October 26th that planned cost-cutting measures include cutting the number of charter aircraft, selling the engineering division and transferring Dan- Air's Headquarters to the parent company’s Horley office. On the positive side, the company says its ship-broking arm has been performing satisfactorily while its travel agency is continuing to maintain improved profits.

James' appointment was not without criticism. The innovatory refinancing package was approved with just hours to spare before the company was said to be placed in administration by its bankers led by Lloyds. Instead the company managed to negotiate a rollover of their existing credit facilities of £40 million whilst securing new lines worth a further £30 million. The new £70 million deal would not need to be renegotiated until January 1992. David James said:'The fuse was getting fairly close to the powder keg.'

In return for this further funding, the banks would get a 'success fee' equivalent to a percentage of the company's net asset value on a given date, certified by accountants. This was believed to be the first time that banks had been offered this kind of incentive to participate in a rescue deal.

David James said that the situation at Davies and Newman was 'unprecedented' and required an 'innovative solution'. The alternative, he said, was administration, a form of insolvency usually involving the break up of the company. In stepping down, Fred Newman, who's family owns 60% of Davies and Newman gave undertakings not to use his stakes not to block crucial changes to the board, except in the case of a bid for the contested company. The details between the company and its creditors were complex. Davies and Newman agreed to pay interest at 2% above LIBOR and the success fee would be based on the valuation of the company in December 1991. the payment would be one third above the net asset value - between £26.25 million and £45 million and 10% of anything above that. But the minimum was set at £8.75 million. Which would mean Davies and Newman having an NAV of £70 million. The fee was unsecured and subordinated to all other creditors. James said that he hoped that this deal would be a 'frontier breaker' Encouraging other companies to go for a similar deal rather than just go for insolvency.

James' appointment came with the reassurance that Dan-Air were no longer looking at selling the airline or joining up with another carrier. They were looking at returning the airline to profitability. One of James' first moves as Chairman, was to replace most of the Board of Directors at Dan-Air with people he had personally chosen. Many had no experience in aviation. He then told the press and the industry that he saw no reason why Dan Air could not be turned around. Dan-Air Engineering (DAE) would remain up for sale. But now James and his team would be giving instructions to Bearings Brothers, who were to oversea the sales should it happen. The price tag of £25 million would give a massive injection of cash to Dan-Air.

Dan-Air Engineering had MADE A PROFIT LAST YEAR. Davies and Newman hoped to retain 20% of the company and use the facilities to maintain their own aircraft. Air Europe then announced they would not be renewing their maintenance contract with Dan-Air and would not be chartering ANY of Dan-Air's aircraft this year.

James' idea revolved around Dan-Air securing a re-finance package and concentrating on becomming a stand alone scheduled airline. He said he wanted to commence a fleet renewal programme. The General Manager - Europe - Vic Sheppard announced that in 1990; 'Dan-Air would be phasing out our smaller aircraft and thinner routes'

Those aircraft would be replaced by newer, quieter and more economical jets on high density routes such as Gatwick - Paris, which would soon be offered up to nine times a day.

Sheppard said;

'I am well aware that people only see Dan-Air as a cheap and cheerful charter airline, and all that goes with that, but when people have tried our scheduled services, in particular the 'Class Elite' they are often pleasantly surprised at the level of service we offer. Our market research shows this, and it shows that they are highly likely to come back for more.'

In 1990, 24% of Dan-Air's scheduled passengers were travelling on business class and 40% of all flights operated flights were done so on the scheduled network. The new company strategy was to take that total to 60% in 1991. The six domestic services into Gatwick already offered interlining with with other airlines or their own flights. In particular, American carriers were impressed with Dan-Air's ability to bring passengers into Gatwick to join their flights Stateside. Dan-Air had no ambitions to enter the long haul market and the interlining agreements worked well. Interlining for those who might know might be include a Dan-Air flight from Newcastle to Gatwick which would be timed to land at Gatwick with enough time for the passenger to transit to an American flight with another carrier. The system worked particularly well for passengers whose regional airport had limited direct destinations. Successive Governments had refused to allow independent airlines access to Heathrow. Air Anglia, the small regional Norwich based carrier had tried in vain to access Heathrow to feed other passengers from several UK airports onto flights to worldwide destinations. Neither British Airways, the British Airport Authority nor the Civil Aviation Authority would permit access other than the most fought after slots. Dan-Air had waited almost thirty years to to gain access with one route and British Midland had less than a handful of services into Heathrow. Other than those two carriers not a single UK independent gained entry to the airport. No charter flights flew out of Heathrow either. Air Anglia were so incensed at being denied entry that they contacted KLM. An Air Anglia manager called David told us.